Why Do Auto Insurance Rates Keep Changing? Here's What You Need to Know!

1. Introduction

Ever noticed your car insurance bill changing even when nothing seems different? You didn’t crash, get a ticket, or buy a new car, but somehow your rate went up. It can be confusing, right? The truth is, a lot factors into how your rate is set. In this blog, we’ll break it down simply so you can understand why rates change and what you can do about it. Let’s dive in!

2. What Is Auto Insurance?

To understand auto insurance rates, it’s important to first know what auto insurance is. Auto insurance is an agreement between you and the insurance company. You pay a premium, and in return, the company helps cover financial losses if your car is damaged, stolen, or if you’re responsible for injuries or property damage in an accident.

3. Everything That Affects How Much You Pay for Car Insurance

So, how do insurance companies come up with your rate? It’s not random. They assess various factors to determine how risky you are to insure. The higher the risk they see, the higher your rate. Here's what they typically consider:

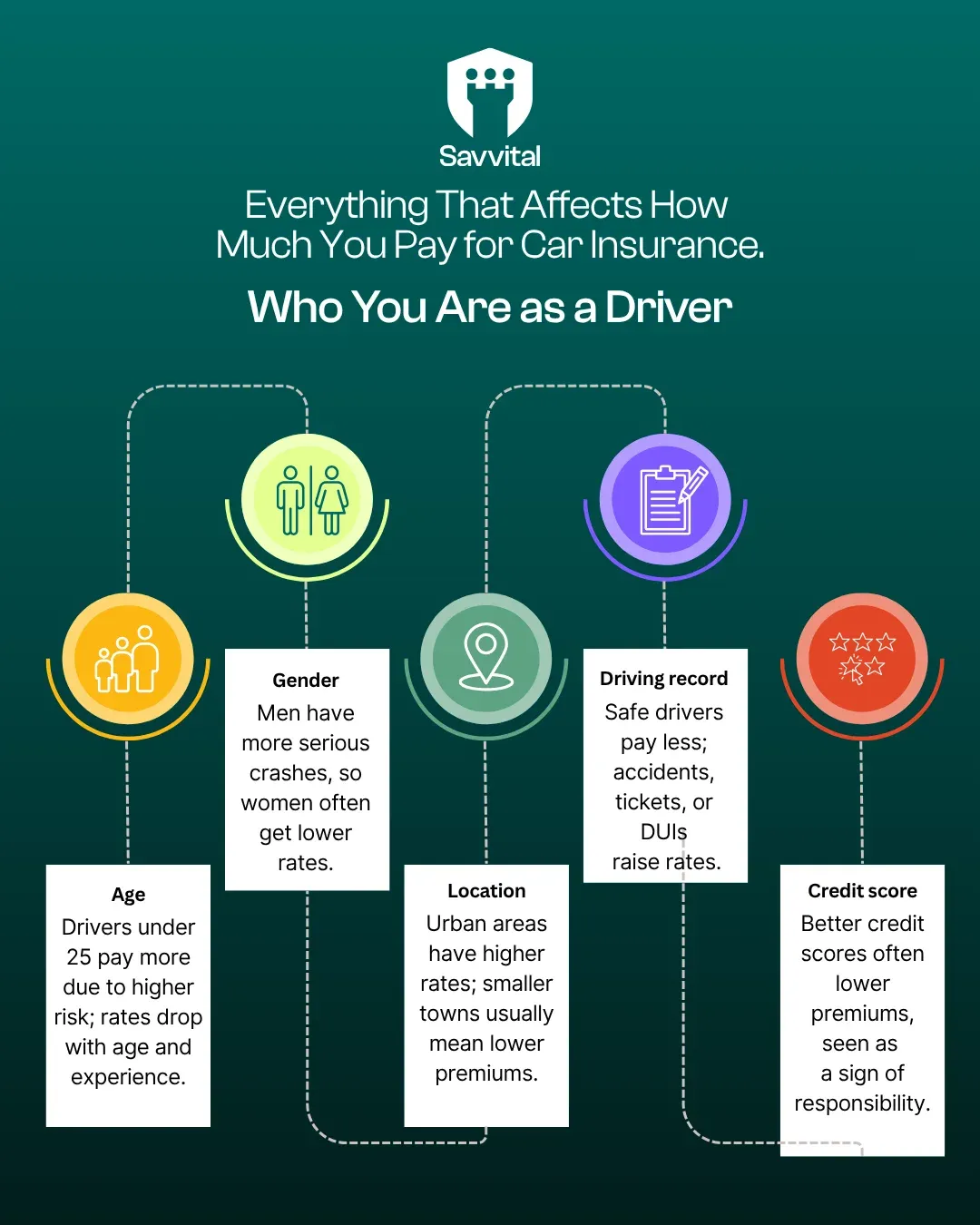

a) Who You Are as a Driver

Your personal details can influence your insurance rate:

- Age: Drivers under 25 usually pay more because they're statistically more likely to be in accidents. Rates drop as you get older and gain experience.

- Gender: Men tend to be in more serious crashes, so women often get slightly lower rates.

- Location: Urban areas usually have higher rates due to more traffic, accidents, and theft. Smaller towns often mean lower premiums.

- Driving record: Safe drivers pay less. Accidents, tickets, or DUIs can raise your rate.

- Credit score: In many states, a better credit score can lead to lower premiums, as insurers see higher scores as a sign of responsibility.

b) What You Drive and How You Use It

- Car make and model: Sports cars, luxury vehicles, and cars prone to theft are more expensive to insure. Also, insurers consider repair costs and safety features.

- Driving habits: More miles on the road means higher risk. Commuting long distances raises your premium, but low-mileage drivers can save with pay-per-mile or low-mileage insurance.

c) How Much Coverage You Choose

- Basic vs. extra coverage: State laws require minimum liability coverage, but you can add more for extra protection. More coverage means a higher premium.

- Deductible: A higher deductible lowers your premium, but make sure you can afford it if you need to file a claim.

d) Other Stuff That Can Affect Your Rate

- Claims history: Multiple claims can signal higher risk, increasing your rates.

- Lapses in coverage: Gaps in your insurance history can raise your premium.

- Your insurance company: Rates vary by insurer. Always compare quotes and check customer reviews to find the best deal.

4. Wait, Why Did My Car Insurance Rate Change?

Okay, now that we know what affects your rate, let’s talk about why it might change over time, even if you feel like nothing’s different.

The truth is, insurance prices are always shifting because of changes in your personal life and the world around you. Even small changes can bump your rate up (or down). Here’s what could be going on:

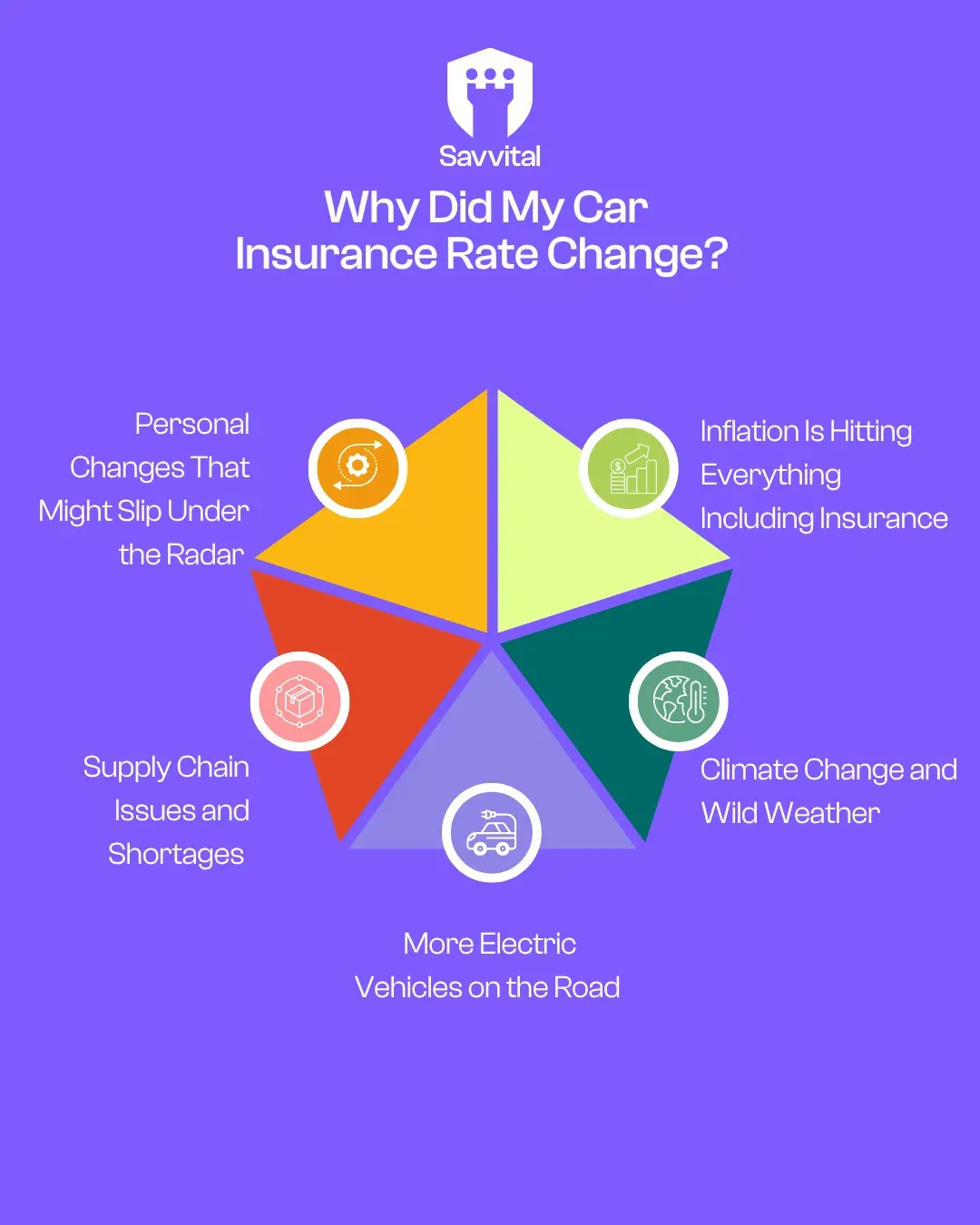

a) Personal Changes That Might Slip Under the Radar

Sometimes you change without really thinking about it in terms of insurance.

- Moved to a new neighborhood? If your new area has more accidents, theft, or vandalism, your premium might go up.

- Driving more than you used to? Higher mileage = higher risk = higher premium.

- Added a new driver? A more experienced driver might lower your rate, but a teen or someone with a rough driving record could raise it.

- Filed a claim recently? That usually leads to a rate increase, even for minor stuff.

b) Supply Chain Issues and Shortages

Remember the pandemic shortages? Yeah, we’re still feeling the effects.

Car parts became harder to get and more expensive, which made repairs cost more. Even now, supply chains haven’t fully bounced back, so insurers are paying more to fix cars and passing that cost on to drivers through higher rates.

c) Climate Change and Wild Weather

Big storms, floods, fires – these aren’t just news stories. They cause major damage to vehicles and lead to a spike in insurance claims.

Insurers raise premiums in areas hit by extreme weather to cover future risks. For example, places like Florida see way higher rates than calmer states like Vermont.

d) More Electric Vehicles on the Road

EVs are awesome for the planet, but not so much for your wallet, at least when it comes to insurance.

They’re packed with advanced tech and can cost more to fix or replace, so insuring them is usually pricier. If you’re thinking about getting one, it’s worth checking the insurance costs ahead of time.

e) Inflation Is Hitting Everything Including Insurance

From groceries to gas, prices are up and auto insurance is no exception.

Car repairs, replacement parts, and even labor at repair shops have all gotten more expensive. So, insurance companies have to raise rates just to keep up with the higher cost of doing business.

5. What Can You Do to Keep Your Rates Low?

Car insurance rates might feel out of your control sometimes, but there are a few things you can do to keep costs down:

- Shop around: Don’t just stick with the same insurer out of habit. Prices change all the time, so it’s worth getting quotes from a few companies to see who’s offering the best deal for your current situation.

- Drive safely: A clean driving record is one of the biggest ways to score lower rates. Avoid accidents, speeding tickets, and other violations, and over time, you’ll likely pay less.

- Only pay for what you need: If you’re working from home and not driving much, you might not need as much coverage as you did before. Review your policy and ditch any extras you don’t really use.

- Bundle your policies: If you have other types of insurance (like home or renters), bundling them with the same company can often get you a nice discount.

- Keep an eye on your credit: In many states, a better credit score can help you get a better rate. Paying bills on time and managing debt can actually save you money on insurance, too.

A little effort can go a long way toward keeping your premiums manageable even when rates are on the rise.

While you can’t control everything, knowing what affects your rate gives you a head start. Stay informed, drive safe, and shop smart!

6. FAQs

Q: Why did my rate go up even though I didn’t file a claim?

A: Insurance rates can go up because of things happening around you like more accidents in your area, rising repair costs, or even inflation. It’s not always something you did.

Q: Does my credit score really affect my car insurance?

A: In most states, yes. A higher credit score usually means you’ll get a better rate, since insurers see it as a sign that you’re financially responsible.

Q: Should I switch insurance companies if my rate goes up?

A: Definitely shop around! If your current rate suddenly jumps, it’s smart to compare quotes from other companies. You might find a better deal with the same or even better coverage.

Q: Can I lower my premium without reducing coverage?

A: Yes! You can try bundling policies, increasing your deductible (if you’re comfortable with that), or qualifying for discounts like good driver, or low mileage.

Q: How often should I review my policy?

A: At least once a year or anytime your situation changes, like moving, getting a new car, or changing how often you drive. Making sure your coverage still fits your needs can save you money.

Published on 27 Jun 2025

Author: Fatima Shahid