What Is HIPAA Compliance? A Simple Guide for Businesses

Introduction

In today's digital world, protecting sensitive health information is more crucial than ever. The Health Insurance Portability and Accountability Act (HIPAA) sets the rules for protecting patient data in the United States. Any business that deals with protected health information (PHI) must comply with HIPAA regulations. This has to be done to safeguard patient privacy and to avoid legal consequences.

This guide explains HIPAA compliance, its importance, and key rules. It also discusses how businesses, especially those in healthcare, can meet compliance requirements. We will also explore how Savvital can support businesses in achieving HIPAA compliance.

Understanding HIPAA Compliance

HIPAA was enacted in 1996 to ensure the confidentiality and availability of PHI. HIPAA compliance means following the rules set by the U.S. Department of Health and Human Services (HHS). This is done to protect sensitive patient information from unauthorized access or misuse.

Businesses that need to comply with HIPAA include:

- Healthcare providers (hospitals, doctors, dentists, clinics, etc.)

- Health plans (insurance companies, HMOs, employer-sponsored health plans)

- Healthcare clearing houses (entities that process nonstandard health information)

- Business associates (third-party vendors handling PHI, such as IT providers and billing services.)

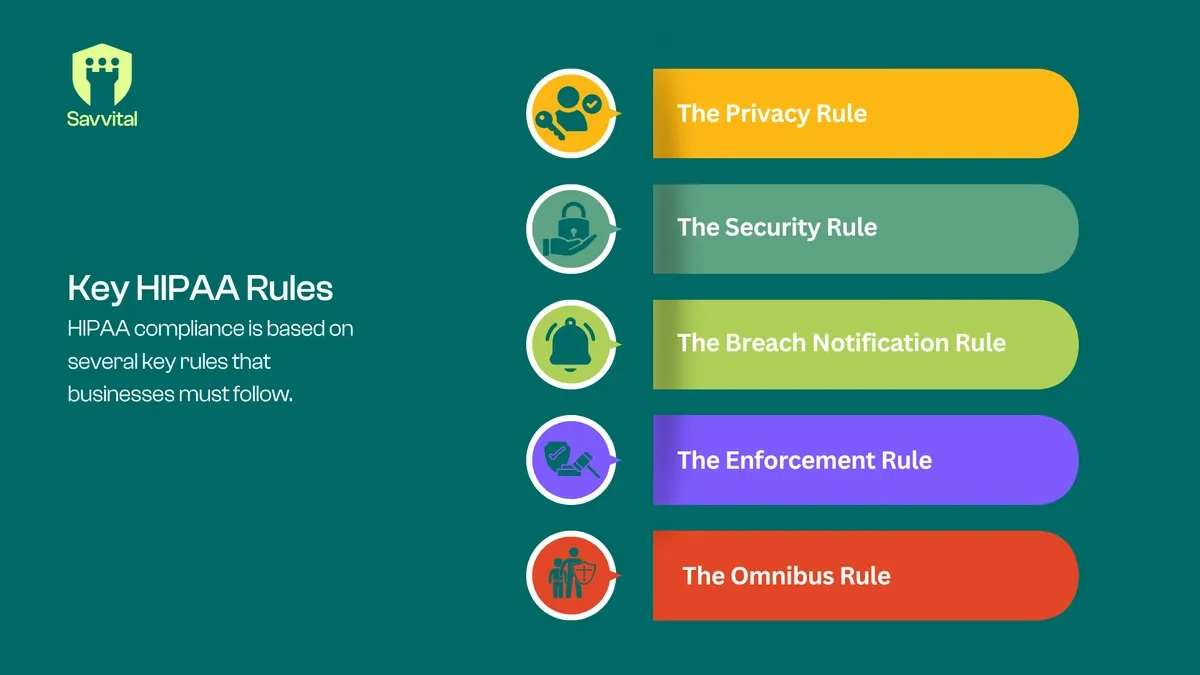

Key HIPAA Rules

HIPAA compliance is based on several key rules that businesses must follow:

1. The Privacy Rule

The Privacy Rule establishes standards to protect individuals’ medical records and other PHI. It applies to healthcare providers, health plans, and their business associates, outlining:

- Who can access PHI

- When PHI can be shared

- Patients’ rights regarding their own health information

2. The Security Rule

The Security Rule focuses on safeguarding electronic PHI (ePHI). This is done by requiring businesses to implement administrative, physical, and technical safeguards. This includes:

- Encrypting electronic health records (EHRs)

- Implementing access controls and authentication methods

- Ensuring data integrity and secure transmission of PHI

3. The Breach Notification Rule

In case of a data breach, this rule mandates covered entities and business associates to notify affected individuals. They also need to notify the HHS, and sometimes the media, depending on the scale of the breach.

4. The Enforcement Rule

The Enforcement Rule establishes penalties for non-compliance. This includes fines that can range from $100 to $50,000 per violation, depending on the severity and intent.

5. The Omnibus Rule

The Omnibus Rule expands HIPAA compliance to business associates and subcontractors. It holds them accountable for protecting PHI. It also strengthens patient rights and modifies privacy and security rules to enhance protection.

Steps to Achieve HIPAA Compliance

Businesses that handle PHI must take specific steps to ensure HIPAA compliance:

1. Conduct a Risk Assessment

A risk assessment helps identify potential vulnerabilities in handling PHI. This allows businesses to implement measures to mitigate risks.

2. Develop Policies and Procedures

Companies must create clear policies covering PHI access, data encryption, and employee training. They should have proper plans in case of a breach.

3. Train Employees

HIPAA training for employees is essential to ensure they understand how to handle PHI securely and comply with the law.

4. Implement Security Measures

Organizations must implement both physical and digital security measures, such as:

- Firewalls and encryption for electronic records

- Secure access controls and password policies

- Locked filing cabinets and restricted access to physical records

5. Sign Business Associate Agreements (BAAs)

If a business shares PHI with third-party vendors, it must have a signed BAA ensuring that the vendor follows HIPAA regulations.

6. Monitor and Audit Regularly

Regular audits help ensure ongoing compliance. This allows businesses to address security gaps before they become a problem.

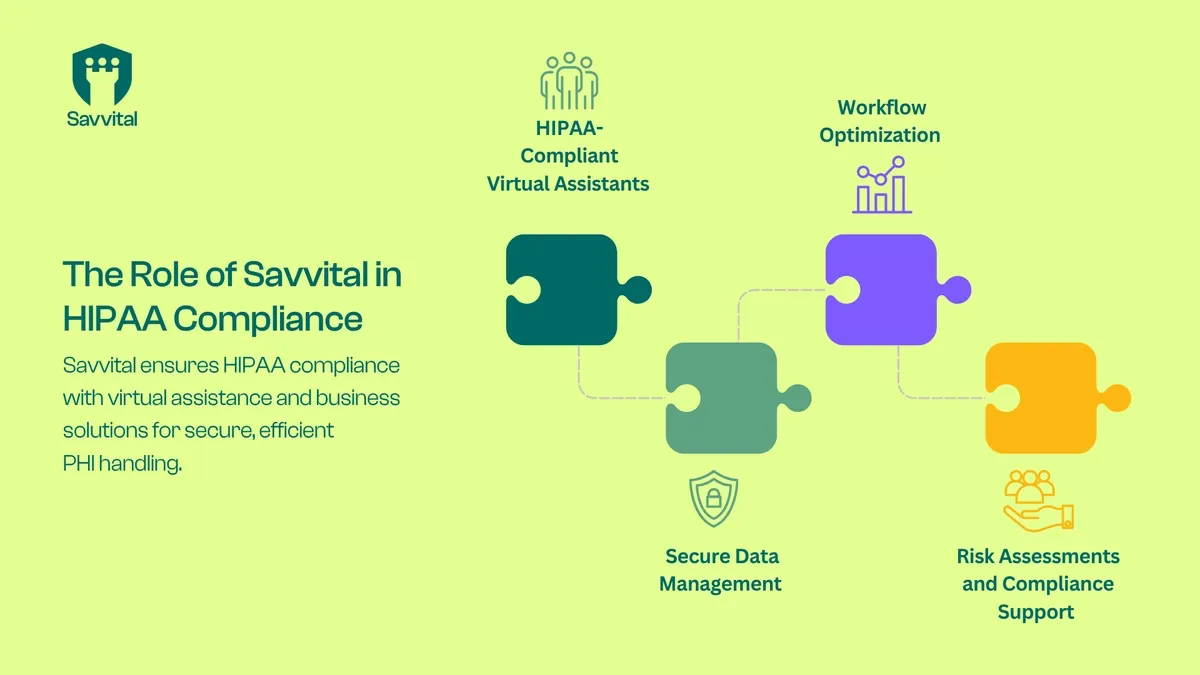

The Role of Savvital in HIPAA Compliance

Savvital plays a crucial role in helping businesses achieve and maintain HIPAA compliance. Savvital provides virtual assistance and business process solutions. Thus, Savvital ensures that companies handling PHI can do so securely and efficiently. Here’s how:

1. HIPAA-Compliant Virtual Assistants

Savvital offers trained virtual assistants who understand HIPAA regulations. They offer services and best practices for handling sensitive information securely.

2. Secure Data Management

Savvital employs industry-standard encryption and secure communication tools. This is done to ensure that PHI remains protected at all times.

3. Workflow Optimization

Savvital helps businesses by streamlining tasks like appointment scheduling, billing and customer support. Savvital enables healthcare providers to focus on patient care while maintaining compliance.

4. Risk Assessments and Compliance Support

Savvital can assist businesses in conducting risk assessments and implementing security measures. Savvital ensures staff compliance through training and policy development.

Consequences of Non-Compliance

Failing to comply with HIPAA regulations can have severe consequences, including:

- Financial Penalties: Businesses can face hefty fines depending on the level of negligence.

- Legal Consequences: Lawsuits from affected patients can arise from data breaches.

- Reputation Damage: A data breach can damage a company’s trust and credibility.

- Loss of Business Opportunities: Not complying with HIPAA regulations has its consequences. Organizations may lose partnerships or contracts with healthcare providers. This can also affect other HIPAA-covered entities.

Conclusion

HIPAA compliance is not just a legal requirement, it’s a commitment. It is done to protect patient privacy and secure sensitive health information. By understanding the key HIPAA rules, businesses can ensure compliance and avoid costly penalties.

Savvital provides essential support to businesses navigating HIPAA compliance. They do this by offering virtual assistant services, data management, and workflow optimization. By partnering with Savvital, companies can focus on growth and efficiency. They can do this while maintaining strict adherence to HIPAA regulations.

For businesses handling PHI, investing in HIPAA compliance is not a regulatory necessity. It’s a step towards building trust, credibility, and long-term success.

Published on 30 May 2025

Author: Fatima Shahid