What Is Health Insurance?

Health insurance is one of those things everyone has heard of but doesn't really get until they actually need it. Essentially, it's an agreement between you and an insurance provider: you pay a monthly fee, known as a premium, and in turn, the insurer subsidizes the cost of your medical treatment. Rather than paying all healthcare costs yourself, your insurance comes in and helps divide the bill when you become ill, injured, or require preventive treatment.

Why Health Insurance Matters

Medical expenses are unpredictable and can be crippling. Even an emergency room visit or an ordinary operation can set you back thousands of dollars. Health insurance helps serve as a safety net, keeping you safe from possibly ruinous medical bills.

But the advantages aren't just for emergencies. Having insurance helps you get preventive care like screenings, vaccinations, and checkups—services that detect possible health problems before they start and keep you healthier over time.

Without insurance, many individuals put off care due to cost, which frequently creates larger, more costly problems down the line.

How Does Health Insurance Work?

When you buy a health insurance policy, you make a monthly premium payment in return for maintaining the coverage. Your insurer splits the cost of medical expenses with you in exchange. Based on the terms of your plan, you might also have:

A deductible – the amount you pay yourself before insurance covers some services.

Copayments – a set charge for certain services, such as a physician visit or medication.

Coinsurance – the proportion of charges you pay after your deductible has been met.

Most plans include an in-network team of doctors, specialists, and hospitals. Being in-network typically saves you money, while going out of network can result in more expenses. Knowing your plan's network saves you from unexpected bills.

Types of Health Insurance Plans

Health insurance isn't a one-size-fits-all solution. The type of plan that's right for you will depend on your employment, income, and health needs. Most common options include:

Employer-sponsored insurance: This is available from many employers that pay some or all of the premium.

Marketplace plans – These are available through the Affordable Care Act at HealthCare.gov or state exchanges, often with subsidies to reduce the individual or family monthly cost for qualified applicants.

Government plans – Medicare covers seniors and individuals with specific disabilities, Medicaid covers low-income citizens, and CHIP provides low-cost care for kids.

Private plans – Bought directly from insurance companies, usually offering individualized choices for individuals who don't fit into employer or government plans.

Both plans have their advantages and disadvantages, and thus it's vital to consider your choices very carefully.

What Does Health Insurance Cover?

The majority of contemporary health insurance policies provide extensive coverage of vital health care services such as:

Preventive services in the form of vaccines, screenings, and regular check-ups.

- Emergency services and inpatient hospital stays for unforeseen injuries or illnesses.

- Prescription drugs for treating acute or chronic illnesses.

- Maternity and postpartum care, including prenatal visits and delivery.

- Mental health and alcohol and drug abuse services, providing holistic treatment of both body and soul.

Details of coverage can also differ widely from plan to plan. Going over your policy information makes you aware of just what is covered and what you may need to pay yourself.

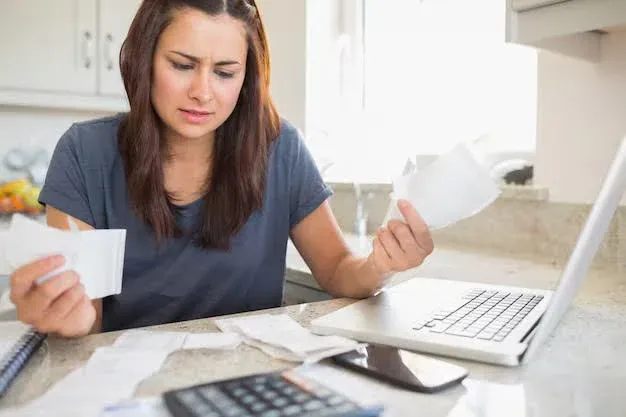

Why Knowing the Costs Is Important

When shopping for health insurance plans, most people consider only the monthly premium. Sure, the premium matters, but it's just a fraction of your overall healthcare cost. Out-of-pocket costs such as deductibles, copays, and coinsurance can also quickly add up, particularly if you have ongoing care.

A less expensive plan with a higher deductible can be the best option for a person who never visits a doctor. In contrast, a person who has high medical needs will likely save more money in total by taking a more expensive plan with lower out-of-pocket expenses. Balancing both of these is the key to avoiding surprises and budgeting better.

Selecting the Appropriate Plan

Your best plan is based on your medical needs, cost, and likes. These are a few things to keep in mind:

Healthcare use – How many times do you see doctors or specialists, and do you use regular medications?

Budget – Can you afford the monthly premium and the deductible if you have care?

Provider network – Does the plan include your favorite doctors, clinics, and hospitals?

Flexibility – Will you accept staying in a network to be cost-effective, or do you want the autonomy to visit any provider?

A licensed insurance broker can make it easy for you by comparing plans, deciphering confusing language, and identifying coverage that fits your requirements.

Why Having Health Insurance Brings Peace of Mind

In addition to safeguarding your pocketbook, health insurance provides something priceless: peace of mind. Knowing you have coverage means you can receive the treatment you require without fear of being overwhelmed with bills. It enables you to put your health first, whether that's by scheduling preventive tests, monitoring chronic illnesses, or addressing sudden emergencies.

Final Thoughts

Health insurance is more than just a monthly bill, it's an investment in your health and financial security. Understanding what it is, how it works, and what it covers empowers you to make better decisions for yourself and your family. With the right plan, you’re not only protected against major medical expenses, but you also gain access to the care that keeps you healthy over time.

Ready to Get the Right Coverage?

Don't know where to begin? Consult a Savvital advisor today to see what's available and get professional advice on selecting a plan that meets your needs for health care and your budget.

Published on 26 Sept 2025

Author: Savvital Team