How Does Health Insurance Work?

Introduction

What Is Health Insurance?

Health insurance is essentially a safety net that will not obligate you to pay for medical care in full. It’s an agreement between you (the policyholder) and an insurance provider. You pay premiums (monthly premiums) to the provider, and they will pay part or all of your medical bills, as your policy dictates.

Consider going to the emergency room without being insured. It can easily run you thousands of dollars. With a health insurance policy, most of that would be absorbed by your carrier, keeping you out of economic devastation. Policies vary tremendously as to coverage and premiums, but that underlying premise never varies: you pool risk and cost with an insurance company, making health care expenditures predictable and affordable.

Why Health Insurance Understanding Matters

Learning how health insurance works is not a nice-to-have but a must-have. Health care in America is pricey, and medical bills are one of the most common reasons for bankruptcy. Without insurance, a simple visit to the hospital can knock your budget off kilter. Additionally, not clearly understanding your policy could result in denied claims, unforeseen medical bills, or forfeiting important benefits.

With the rise of high-deductible health plans and complex insurance networks, it's more crucial than ever to be an informed consumer. Whether you're picking a new plan or figuring out a bill, knowing the basics can mean the difference between confidence and chaos. Let’s break it all down step by step.

Health Insurance Essentials

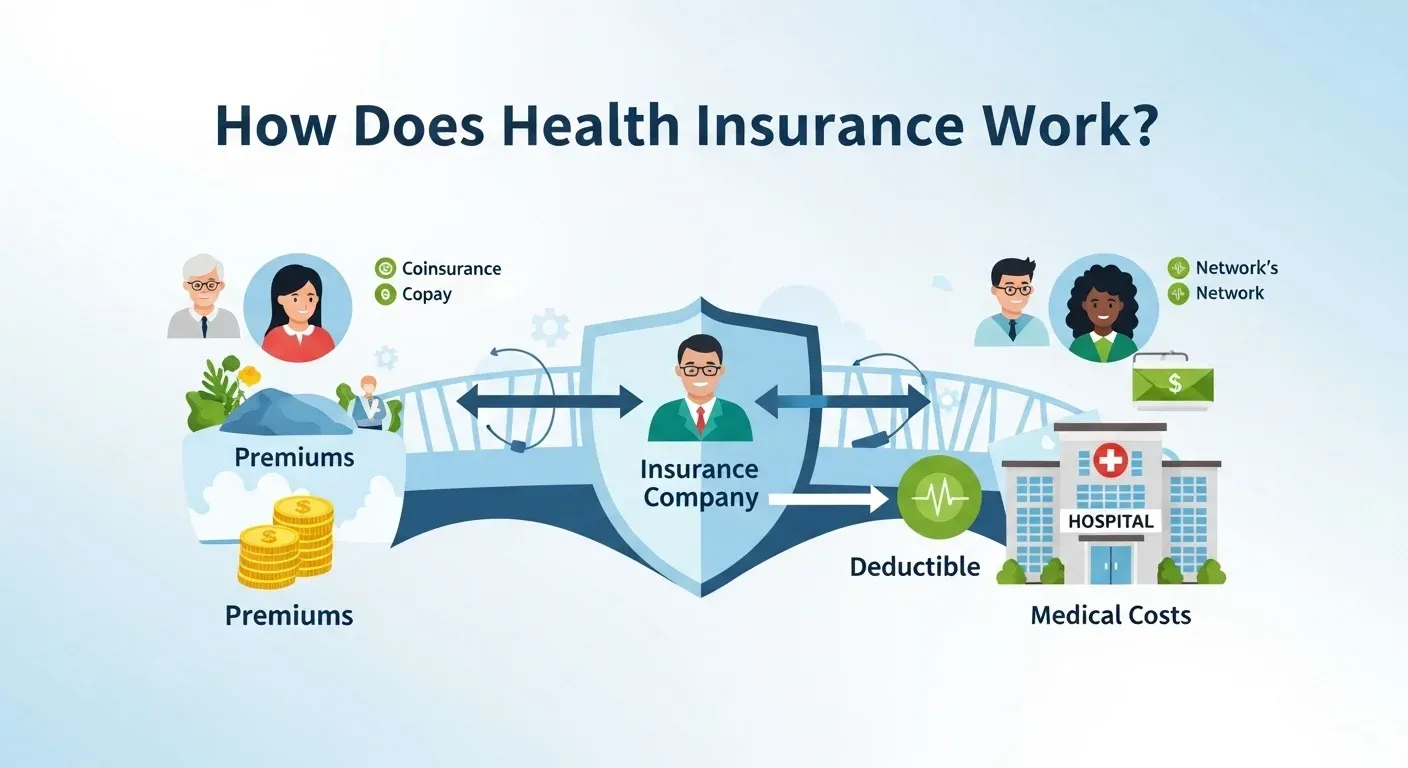

How Health Insurance Works

Health insurance essentially pools risk. You and countless others pay into this pool through premiums. If someone requires healthcare, the insurance company uses that to pay part of the bill. You can still end up paying part (through deductibles or copays), but most of this is taken care of by the insurer.

For instance, let's say you need a surgery that will cost you $10,000. If your deductible is $2,000 and your coinsurance is 20%, you’d pay $2,000 out-of-pocket, then 20% of the rest of the $8,000 (which is equal to $1,600). You’d pay a total of $3,600 out-of-pocket, with your insurance picking up the rest of the bill. Without insurance, you'd pay all $10,000.

There are also network rules the majority of insurance providers have arrangements with individual physicians and hospitals. If you go "out-of-network," your bill could go up significantly, or your claim could be denied outright. That’s why you need to know your plan’s network, benefits, and restrictions.

Health Insurance Key Players

There are various significant players within the health insurance ecosystem:

- Policyholder: That’s you, the insured person.

- Insurance Provider: The insurance company that provides coverage (e.g., Blue Cross, UnitedHealthcare

- Healthcare Providers: Physicians, clinics, and hospitals that offer services.

- Employers often pay premium rates if they cover you.

- Government Agencies: Oversee and at times offer insurance (e.g., Medicare, Medicaid, ACA marketplaces).

Recognizing those players informs us how money flows within the system and where blame falls when something goes amiss.

Types of Health Insurance Plans

Employer-Sponsored Health Insurance

This is the most prevalent form of health insurance in America. Insurers usually negotiate with employers to arrange group plans, then sell them to the employees at a lower price. The employer usually pays most of the premium costs, thus making this insurance affordable to employees.

Employer-sponsored plans are often better than individual plans in terms of cost and coverage, but they come with downsides. For example, you're limited to the plans your employer offers. And if you change jobs or get laid off, your coverage might end, though COBRA allows temporary continuation at a much higher cost.

It should also be mentioned that there are employers who have tiered plans—such as a basic HMO and a less restrictive PPO, allowing employees to make a decision based on budget and healthcare requirements.

Health Insurance for Individuals and Families

You may need to purchase insurance individually if you are self-employed, unemployed, or your employer does not provide benefits. You can go shopping for plans within the ACA marketplace (Healthcare.gov) or directly with insurance providers.

These plans range significantly in price and coverage. Based on your income, you may be eligible for subsidies to help reduce your premiums each month. Individual plans can be customized closer to your individual requirements but are generally pricier without employer contributions.

Family plans include spouses and dependents, but watch out—opting to include family members can substantially increase your premium. Always comparison-shop various plan levels (bronze, silver, gold, platinum) based on your anticipated medical use.

Government Health Insurance Plans (Medicare, Medicaid, ACA)

- Medicare is primarily for people aged 65+ or with certain disabilities. It has several parts (A for hospital, B for doctor visits, D for prescriptions).

- Medicaid: Assists low-income families and individuals. Coverage depends upon income and family size, and benefits are frequently more comprehensive than those of private plans.

- ACA Plans (Affordable Care Act) are offered through state and federal marketplaces and are not allowed to deny coverage for pre-existing conditions. The plans are required to include essential benefits such as preventive care, maternity care, and mental health care.

Health Insurance Policy Components

Premiums, Deductibles, Copayments, and Coinsurance

Let’s decode the jargon:

- Premium: The payment you make every month to maintain your coverage, whether you utilize any service or not.

- Deductible: The dollar amount that you pay out-of-pocket per year before coverage begins.

- Copayment (Copay): A set price that you pay for a service (e.g., $30 for a physician visit).

- Coinsurance: A percentage of costs you share with the insurer after hitting your deductible.

Ready for Expert Guidance?

Not sure where to start? Speak with a Savvital advisor today for personalized help navigating your options and choosing a plan that fits your needs and your budget.

Published on 29 Sept 2025

Author: Savvital Team