How Do I Get Health Insurance?

For most, the world of health insurance can seem intimidating. The process is foreign language terms, numerous plan choices, and a lot of small print. But having coverage matters safeguarding you against the financial blow of surprise medical bills and providing access to the treatment you need. The best news? Once you know what's available and what to search for, purchasing health insurance becomes much less daunting.

Understanding the Various Paths to Coverage

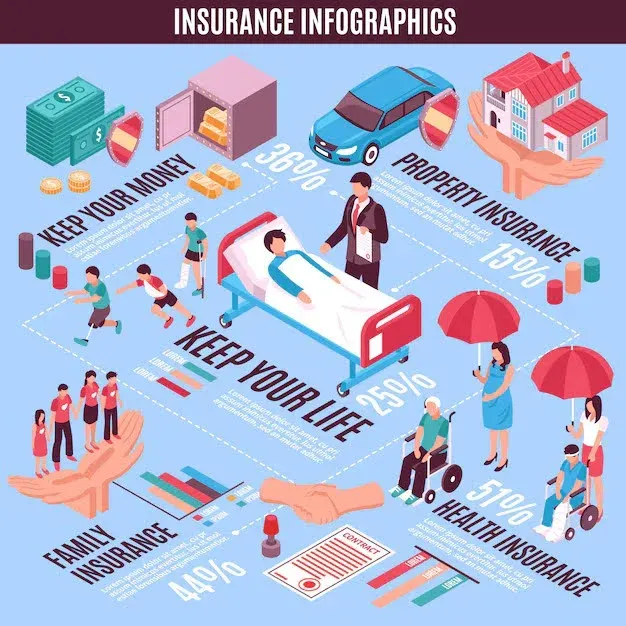

There is no single plan that fits everyone, and the appropriate option is based on your situation, work status, and finances. Most individuals obtain coverage in one of the following ways:

Employer-sponsored coverage – Group plans are often offered by companies, with some or all of the premium paid by the employer. These plans tend to offer complete benefits at a reduced individual expense.

Marketplace plans – With the Affordable Care Act (ACA), you can shop and buy plans on HealthCare.gov or through your state exchange. Marketplace plans are uniform, and most people are eligible for subsidies that lower premiums.

Government programs – Medicaid provides low-cost or free coverage to individuals with limited income, Medicare covers seniors and some individuals with disabilities, and CHIP offers low-cost care for children in families meeting certain requirements.

Private brokers – Licensed insurance brokers can help you compare plans from multiple insurers, explain the details, and match you with coverage that meets your needs and budget.

Knowing which path suits you best helps narrow the choices and simplifies the search.

Assessing Your Needs Before You Choose

Before you start comparing plans, take a moment to evaluate your healthcare habits and priorities. Ask yourself:

- Do you ever need prescription drugs, specialist care, or mental health treatment?

- How often do you usually see physicians or clinics?

- How much monthly premium can you afford and how much could you pay out-of-pocket in case of a big medical bill?

Having definitive answers to these questions will help you toward a plan that really matches your lifestyle. For example, someone with little healthcare needs may value a lower premium, whereas someone with chronic conditions may value a plan with a higher premium but less out-of-pocket expense.

Knowing Enrollment Windows

Health insurance is not always on demand. Most plans have established enrollment windows, and failing to meet them can restrict your choices.

Open Enrollment Period (OEP) – Typically takes place once a year, when you have the opportunity to enroll in a new plan or change an existing one.

Special Enrollment Period (SEP) – If you have a qualifying life event such as losing other coverage, marriage, or having a baby you might be able to enroll outside of the normal window.

Highlighting these dates in your calendar ensures you do not miss the chance to procure or renew your cover.

Comparing Plans: Don't Look Just at the Premium

When comparing plans, the premium for each month tends to receive the most attention, yet it is only part of the overall picture. Look at the cost of care and what you are covered for:

Deductibles and out-of-pocket limits – How much will you pay out-of-pocket before coverage begins, and how much could you pay in a year?

Network providers – Are your doctors, specialists, and hospitals included?

Coverage benefits – Does the plan cover services that you know you'll need, such as maternity care, mental health treatment, or preventive care?

A policy with a somewhat higher monthly rate could potentially save you money in the long run if it provides more effective coverage for your particular requirements.

Getting Help When You Need It

You don't need to do it alone. Navigators and licensed health insurance brokers can clarify your choices, contrast plans, and walk you through the sign-up process sometimes free of charge. These professionals know the loopholes and can steer you clear of plans that cost less but won't provide the coverage you really require.

For those who prefer self-guided research, online resources like HealthCare.gov and insurer websites provide tools to compare premiums, coverage, and provider networks side by side.

Why Coverage Matters More Than Ever

Health insurance is not just an economic protection. It means you will be able to obtain preventive care, treat chronic illnesses, and receive emergency services without the threat of debilitating medical expenses. One single unexpected hospital stay will cost thousands of dollars far exceeding the cost of most insurance premiums on an annual basis.

Beyond financial protection, having coverage means peace of mind. You’ll know that when the unexpected happens, you can focus on getting the care you need rather than worrying about how to pay for it.

Taking the Next Step

Acquiring health insurance need not be stressful. By knowing what types of coverage exist, analyzing your needs, and comparing carefully, you can acquire protection that will serve both your health and your budget well. Keep in mind that the most inexpensive plan is not necessarily the best value in finding a balance between affordable premiums and full coverage.

If you find yourself overwhelmed by options, get assistance. Brokers, navigators, and trusted counsel can make the process easy, preventing you from missing deadlines or failing to take advantage of better plans that suit your situation.

Final Thoughts

Health insurance is a vital investment in your overall health. With some research and the right advice, getting the proper coverage can be a straightforward, even empowering, experience. Don't put it off until you're facing medical bills. Taking the plunge now can shield both your finances and your health.

Ready for Expert Guidance?

Need help getting started? Talk to a Savvital advisor today for individualised assistance in exploring your choices and selecting a plan that is right for your healthcare needs and your budget.

Published on 25 Sept 2025

Author: Savvital Team