Affordable Umbrella Insurance for Homeowners: A Smart, Low-Cost Safety Net

If you own a home in the U.S., you likely already have homeowners insurance. It protects your house and belongings from things like fire, storms, or theft. But what happens if someone gets hurt on your property and sues you for more than your policy covers?

That’s where umbrella insurance comes in. It gives you extra protection at a low cost.

In this post, we’ll explain what umbrella insurance is, why it’s useful for homeowners, and how you can get it without breaking the bank.

What Is Umbrella Insurance?

Umbrella insurance is a type of liability coverage. It helps pay for costs when a claim goes over the limits of your regular home or auto insurance.

For example, if someone gets hurt at your home and sues you for $1 million, but your homeowners insurance only covers $300,000, umbrella insurance can help cover the rest.

It also helps with other types of claims, like:

• Legal fees

• Medical bills

• Lost wages for the injured person

• Damage to someone else’s property

• Slander, libel, or defamation lawsuits

Umbrella insurance covers not just your home but also your car and other situations where you may be at fault.

Why Homeowners Should Consider It

Homeowners are more at risk for lawsuits than renters. If someone is hurt on your property, they can sue you. That lawsuit could cost more than your standard insurance covers.

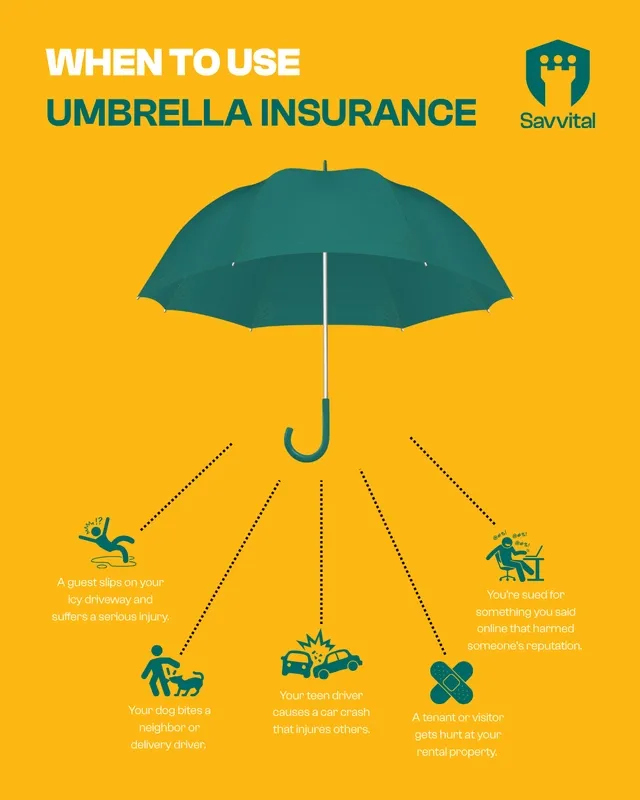

Here are some real-life examples:

• A guest slips on your icy driveway and suffers a serious injury.

• Your dog bites a neighbor or delivery driver.

• Your teen driver causes a car crash that injures others.

• You’re sued for something you said online that harmed someone’s reputation.

• A tenant or visitor gets hurt at your rental property.

In any of these cases, you could end up owing hundreds of thousands—or even millions—of dollars. You'd be responsible for the rest if your regular insurance doesn’t cover the full amount. Umbrella insurance can protect your savings, home, and future income.

How Much Coverage Do You Get?

Most umbrella insurance policies start at $1 million in coverage. You can buy more coverage, up to $10 million or more, depending on what you need.

Your coverage amount should match your assets. If you have a home, cars, investment, or retirement account, umbrella insurance can protect them.

Is Umbrella Insurance Expensive?

Not at all. Umbrella insurance is very affordable, especially for the amount of coverage it gives.

Here’s what it typically costs:

• $1 million in coverage: $150–$300 per year

• Each extra $1 million: $75–$100 per year

That means for less than $1 per day, you can protect yourself from huge legal costs.

The exact cost depends on:

• Where you live

• How many homes, cars, or drivers you have

• Your driving record

• Your insurance company

Still, for most people, it’s a small price for major protection.

How to Find an Affordable Policy

Want to get a good deal on umbrella insurance?

Here are five simple tips:

1. Bundle Your Policies

Most companies offer discounts when you buy home, auto, and umbrella insurance together.

2. Compare Quotes

Don’t just go with the first offer. Ask for quotes from several companies to find the best price and coverage.

3. Use an Independent Agent

An agent can help you compare policies from many insurance companies. They’ll find a plan that fits your needs and budget.

4. Know Your Risk

You may need more coverage if you have a high-risk lifestyle. That includes owning rental property, having a pool, or having teen drivers in the house.

5. Review Each Year

Your assets change over time. Make sure your coverage keeps up. Check your policy every year to stay protected.

Who Needs Umbrella Insurance?

You don’t have to be rich to need umbrella insurance. If you have anything worth protecting—your home, savings, or future income—it’s a smart choice.

You should consider umbrella insurance if you:

• Own a home or rental property

• Have savings or investments

• Host guests often

• Own a pool or trampoline

• Have a teen or high-risk driver in your family

• Are active on social media

• Volunteer or serve on a board

Even if you don’t think you’re at risk, a single lawsuit can change everything. Umbrella insurance gives you peace of mind.

Understanding Umbrella Insurance and Liability

In today’s world, lawsuits are common—and expensive. Your regular homeowners policy may not be enough. Umbrella insurance adds an extra layer of protection for your home, car, savings, and future.

Best of all, it’s affordable. For just a few hundred dollars a year, you can protect yourself from financial disaster.

FAQ Section

- What information is needed for a home insurance quote?

To get a home insurance quote, you'll need information about the property, including its value, location, age, and details about your personal belongings and coverage preferences. - Why are my insurance quotes so high?

Insurance quotes can be high due to factors like your driving history, the car model, your location, and the level of coverage you choose. - How long does an insurance claim on a house process?

Home insurance claims typically take anywhere from a few days to several weeks, depending on the severity of the damage, complexity of the claim, and the insurance company’s processes. - What triggers a commercial insurance claim?

A commercial insurance claim can be triggered by incidents such as property damage, liability claims, or employee-related injuries in a business setting. - Does making a homeowners insurance claim automatically increase your rates?

Making a homeowners insurance claim may cause your rates to increase, particularly if you file multiple claims in a short period. - How long does it take insurance to process a claim?

The processing time for an insurance claim can vary depending on the type of claim, but it typically takes a few weeks for the insurance company to finalize the payout.

Published on 22 May 2025

Author: Yuwani Perera